Two very interesting interviews with US Airways executives

You’ve probably read as many articles about the merger between American and US Airways as I have, and with both airlines having just wrapped up the SEC mandated quiet period that was imposed in advance of the July 12 US Airways shareholder vote, there hasn’t been much merger news lately.

For me the upside of the quiet period has been that it’s allowed me to get caught up on some of my reading.

I came across two interviews with US Airways executives that I thought were worth sharing.

The first was an interview with Andrew Nocella, US Airways’s senior vice president of marketing and planning who has also been named as the chief marketing officer of the new American Airlines. He sat down with Brian Sumers of Inside SoCal to talk about how the merger will impact the Los Angeles market.

Discussing the US approach to the LAX market:

US Airways has been “a somewhat niche player in the marketplace we knew we couldn’t be big in every market. We focused efforts in the places where we thought we could be most profitable. In this particular case, Los Angeles is a great spoke for US Airways today. It’s a profitable operation for US Airways so we are very happy with it.”

And in the future:

Los Angeles is a top business market – No. 2 in the country behind New York. We intend to make sure we will keep the operations in all nine (new American) hubs going forward. Los Angeles and New York are a very important to the strategy.

The strategy of a stand-alone US Airways is different than the strategy of a merged US Airways and American. Times change and we will adjust our business philosophy and strategies accordingly.

It’s the first interview (that I can recall) where an US exec has so plainly said that running an airline the size of American is very different than running an airline the size of US.

You can read the entire interview here: US Airways and American merger: What it might mean for Los Angeles

Another article worthing mentioning is one from Jay Boehmer at Business Travel News, it’s the most detailed outline of merger planning and timelines that I’ve read.

He quotes Robert Isom, US Airways COO and future COO of the new American:

“the underlying premise of the principle is to favor AA’s approach. “US Airways is about half the size of American,” he said. “For the most part, for passenger- and employee-facing systems, we’re probably going to rely on bigger carrier systems. There is no need to go out and train everyone. You want to minimize disruption.”

“A relatively small portion of integration work will be guided by a desire to more quickly “harmonize to best-of-breed,” wherein new policies, procedures and systems would be introduced, executives said. “You’ll see a lot of this around product offerings, policies and certain aspects of amenities,” said Isom.

Hmmm…..I would love to know how they define “best-of-breed”.

To read the rest of the interview go here: Merger Planning Underway As AA, US Airways Embark On Long Journey

Both articles are worth reading. Let me know what you think!

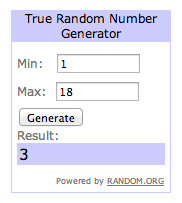

Reader Giveaway Results

Thanks to everyone who entered my reader giveaway. We have two winners, each of whom will receive an Admirals Club day pass.

And the winners are Neer and Abhishek D!

A big thanks to JJ from Blind Bargains and AJ from Live from a Lounge for donating the day passes!

Thanks everyone for all the food tips and thanks for entering!

We’ll see what ‘Best in Breed’ turns out to me, won’t we? 🙂

With Delta-Northwest they called it “Best in Class.” Historically this has meant, “Enhance me, baby!”

The evidence of course is nowhere near in!

Sadly I think we all know where things will end up, and it’s not to most customers’ benefit (which is no surprise):

“harmonize to best-of-breed” Translation: As Gary said, “enhancements” that will improve the airline’s bottom line while being generally disadvantageous to customers.

“You’ll see a lot of this around product offerings, policies” Translation: Oh, things like increased and more fees (welcome to USAirways’ $25 fee just for an online award res, for example), more restrictions, I don’t know, maybe worse hard and soft product offerings.

“and certain aspects of amenities” Translation: Devalued elite programs; earn and burn devaluations.

With only 3 major legacies left, and COdbaUA and DL already showing their eagerness to race to the bottom, I wouldn’t expect much from the “new AA”

It seems extremely likely that US’s flights at LAX will be consolidated with AA at T4 – since WN is bursting at the seams at T1. But AA is boxed in at T4… the RJs already operate from a remote building, and DL has all of T5 and TBIT is on the other side. There’s zero capacity for growth, and in fact to fit in the US flights, it seems like they may have to shrink the combined operation at LAX, which is normally what happens with mergers anyhow…